More than 40 countries, EU and beyond

VATify.eu tracks business subjects from over 40 EU and non-EU countries, covering a 700 million market: from Porto in the west to Vladivostok in the east and from Svalbard in the north to Israel in the south.

It's not limited to just VIES(VAT Information Exchange System), but also uses services provided by countries' own tax, customs and other financial/fiscal authorities.

Fully automated

The system operates by verifying your business partners' data automatically on a daily basis; it will source information from official registries and other public internet services, check for any changes, update the central VATify database and notify you as necessary.

This saves time, money and frustrations: no need for manual VIES checks and no more dealings with the tax office due to unrightfully deducted VAT.

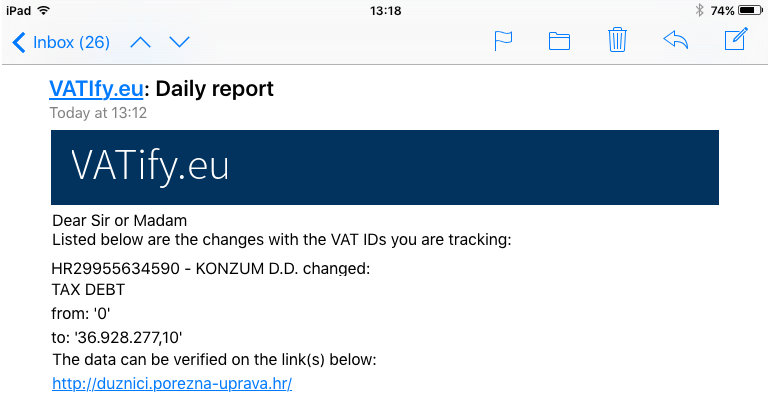

Discrete, effective alerts

VATify.eu only produces an alert when there was a change regarding a company you are tracking. All such alerts are combined into a single daily report that you receive by email.

Every alert contains just the right information to instantly realize what has changed and about which company. Of course, a link to the official source is also provided to help you manually verify company information.

Here is an example of a daily report email.

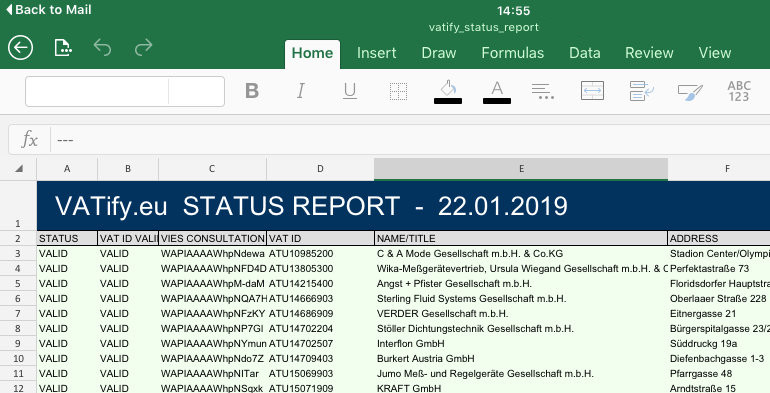

Status reports (with spreadsheets)

To keep you informed, a status report is delivered to your inbox once every week. Attached is a spreadsheet containing all available data on companies you are tracking.

Once registered, you can sign in at any time and request an up-to-date status report to be sent to you immediately.

Download a sample status report (XLSX file).

No passwords (or usernames)

Since VATify.eu processes only public data, there is no need for you to remember usernames, passwords, secrets... Your email address is your ID, and this is all that the VATify.eu system knows about you.

To sign in to the service, instead of using your username and password, you will receive an email containing special links. Open them in your browser to perform the tasks needed (e.g. edit your subscription or update the list of companies you are tracking).

Extra services for your special needs

Additional services are also available, such as SMS notifications or unlimited historical records for the companies you are tracking.

Status reports can be sent in machine readable format(e.g. CSV or JSON)at a specified time of day. And you can get daily notifications by Fax.* We will care to your needs and are open to your suggestions.

*Fax can be considered an outdated technology, but it does get everyone's attention when it starts making noise.

Constant improvements

New features are added whenever we find a new source of publicly available data that can be processed automatically. If you know of a good source or have any other ideas, please contact us.

We live in an interconnected world, drowning in all kinds of data, yet a lot of basic information is hard to come by. It is scattered on various sites and databases at different organizations, agencies, ministries... This is why we have tackled this challenge and devised a way to automate the processes of extracting this data from some very diverse public records, unifying it and use it for ourselves and our clients — but also offer it to others for a small fee. The fee covers the costs of data acquisition, internal processing and notification delivery through the most common media available today: email.